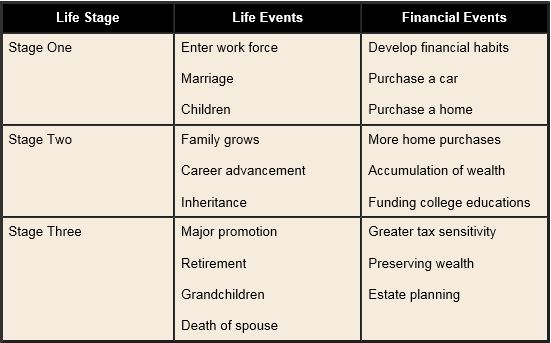

As you get older, hopes and dreams for the future begin to expand – buying a car or house, starting a family, and eventually retiring. These dreams are exciting and are something to look forward to, but they also require saving money. A financial plan helps decide what your goals are and how to effectively save for them. This includes a budget, tracking expenses, and bills, and planning for your financial life stages.

Stage One – Build a Financial Foundation

This is the financial life stage where you are generally starting your career and learning financial habits. In this stage, a household budget can shape good spending and saving habits, as well as help build a financial foundation. Building good credit is another aspect of this stage, especially if you intend to buy a car or house. This can be achieved in a few ways. Borrowing money for long-term investments and making on-time or early payments is a great way to build credit. Another way, which requires more responsibility, is by using credit cards. When using this form of borrowing money, make sure you are still living within your means.

At this point, you should start making more money than you’re spending; an automatic savings plan can help you establish a good saving pattern. Another way to create strong habits is by setting goals such as saving for a down payment or a vacation. Goals help create motivation and discipline, which are critical aspects of building strong financial habits.

This right level of insurance coverage is key in this stage. Although you may not have dependents yet, it is important to make sure you are protected if something were to prevent you from working. Another key point is to make sure you are taking advantage of your employee benefits plan. Not only will they often offer insurance, generally employers will offer a retirement plan, such as a 401K, which will help you prepare for the next financial life stages.

Stage Two – Save During Prime Earning Years

At this stage, income, as well as expenses, are rising. Expenses that come with starting a family, upgrading your home or car, or even taking family vacations can quickly consume your extra income. Taking full advantage of your employer offered retirement plans is very important during this stage. Your saving habits here will directly affect your retirement lifestyle capabilities. Contribute as much as you can, or at least enough to get the full employer matching contribution. The earlier you start investing, the more time your money will grow.

If you plan on starting a family, start saving for college expenses early. Consider opening and contributing to Education IRAs, or a similar college fund account. These come with tax advantages, where a normal savings account would not. When choosing which plans to invest in, make sure the plan follows your timelines, whether it be for college tuition or retirement plans.

Insurance is still imperative to keep up to date as your family and needs have grown. Make sure your family is protected if something unexpected were to happen to you. Another way to protect your family, as well as ensure your wishes are carried out, is by creating an estate plan. Also, this provides peace of mind as you head into the third stage of your financial life.

Stage Three – Nearing or During Retirement

Preparing for and enjoying retirement is the third financial life stage. This is where you get to reap the rewards of your hard work and saving habits. Enjoy these years and everything they entail. For some, children and grandchildren can be the most rewarding part, especially if you are able to help them start planning for their goals. You worked hard to reach this point and you are entitled to enjoy it. However, there are some matters to be aware of.

Having proper insurance is still critical, as health gets harder to predict. Generally, people are starting to live longer, but that also comes with increasing costs. Another issue to be aware of is keeping your estate plan up to date. Any living arrangement, family, or income changes should cause you to review your plan. Any time you talk with a financial adviser, make sure you trust them and can understand their recommendations. Wise investing is important at any stage, so make sure you understand where you are putting your money and that it makes sense for you. Lastly, make sure to enjoy this stage, you’ve certainly earned it!

Bank Five Nine works with trustworthy financial advisors and offers many different services to fit your financial life stage needs. If you have any questions, feel free to contact Bank Five Nine!