A good financial education is an incredible gift, and one that begins in the home. Schools will only scratch the surface when it comes to teaching kids the difference between wants and needs, the value of something free, such as playing with a friend, or that late bills can hurt their credit history and their chance of getting a job. For all of these financial lessons, it’s up to us – the parents, grandparents, guardians and loved ones – to provide our children the opportunity to learn. And the earlier we get started, the better.

Here are a few financial education tips for kids of all ages:

3 – 5 Year Olds

Should Know:

- You need money to live.

- You earn money by working.

- There’s a difference between “wants” and “needs”.

- Sometimes you have to wait before you can buy.

To Do:

- Identify coins and their value.

- Discuss which is more important; buying milk or candy.

- Label three containers: Saving, Spending and Sharing, and use them accordingly.

6 – 10 Years Old

Should Know:

- You have to make choices about how to spend your money.

- It can be dangerous to share information.

- A savings account is safe and earns interest.

To Do:

- Give your child two dollars, and let them choose an item and pay the cashier.

- Set rules about giving out personal information.

- Know the websites your child visits and block inappropriate sites.

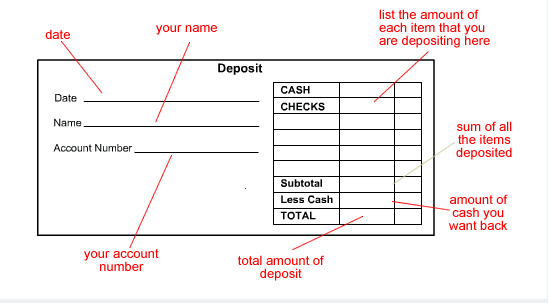

- Make trips to the bank with your child and open a savings account.

11 – 18 Years old

Should Know:

- How much of every dollar should be saved (i.e. 10% of every dollar).

- The reality of ID theft and fraud.

- The sooner you save, the faster your money can grow.

- Credit card risks.

- Money is taken out of paychecks for taxes, and why.

To Do:

- Have your child set a goal to buy something, and save for it.

- Consider putting in $.25 for every dollar your child saves.

- Discuss examples of text, email and mail fraud.

- Make it a rule that your child never answers an email or text from a stranger.

- Show a simple example of compound interest.

18+

Should Know:

- Only use a credit card if you can pay it off.

- You need health, renters and auto insurance.

- Have an Emergency Fund (3 to 6 months of living expenses).

- The ins and outs of investing.

To Do:

- List out income and expenses to get a clear picture of what you spend and can save.

- Define two financial goals (i.e. college, new car) and make a plan to achieve them.

- Explain the importance of participating in their office retirement plan.

- Discuss why good credit matters and how to get it.

- Get one free credit report a year.

- Comparison shop for insurance.

There are many resources available to help provide your children effective financial education. Take advantage of them.

We’re here to help! If you need assistance with early financial education, call or stop in today.

Recent Comments