-

Chat

We are here to help! Connect with us.

Call (888) 569-9909 during business hours for additional support.

- Monday-Friday: 8:30 AM – 5:30 PM

- Saturday: 8:30 AM – 12:00 PM

-

Login

Do you ever feel like your paycheck disappears faster than you expected, even though you’ve got a full-time job? That’s exactly how Gabe felt until he sat down with financial coach Brielle for a no-pressure conversation about money and mindset.

Let’s walk through their step-by-step approach to making a budget you can actually stick to.

Start by writing down how much money you take home each month after taxes.

Example: Gabe earns $4,000/month after taxes.

This number will serve as the foundation for your budget.

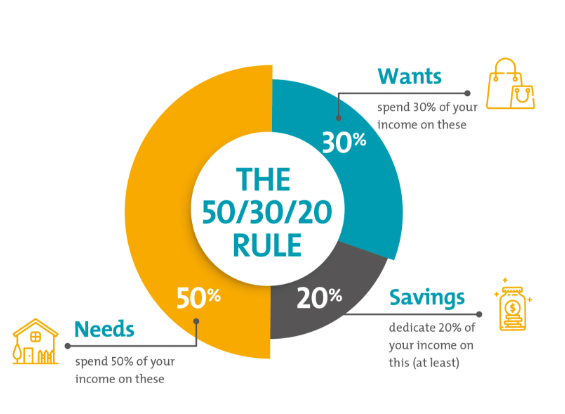

The 50/30/20 method is a simple, flexible way to organize your spending:

It’s okay if your numbers aren’t exact, but aim for these general ratios to build a solid financial foundation.

You can use a spreadsheet, an app, or a printable worksheet (ask your local Bank Five Nine team!). Gabe filled in these categories:

Essentials:

Total Essentials: $2,800

Wants:

Total Wants: $900

Total Monthly Expenses: $3,700

Budget Surplus: $300

With $300 left over, Gabe decided to:

Want to grow your surplus? Consider:

Using a budgeting app that alerts you to spending patterns. You can also use our Budgeting Calculators to help you stay on track.

Budgeting isn’t one-and-done. Revisit your numbers monthly, especially if your income or expenses change. Automate your savings and debt payments so your goals stay on track, even when life gets busy.

Bank Five Nine Tip: Look at your statements weekly or twice a month. Awareness is your budgeting superpower.

Visit your nearest Bank Five Nine branch or connect with a banking advisor for support in:

Let’s build a plan that works for you.

A simple method where 50% of income goes to needs, 30% to wants, and 20% to savings or debt.

Check in at least monthly, or more often if your income or expenses change.

If you have a surplus, hit your savings goals, and don’t rely on credit to get through the month, you’re on track.

Budgeting apps, bank statement reviews, printable trackers, and digital calculators all make it easier.