Owning and renting each have their advantages, but what’s best for you depends on your circumstances. Some great things about owning are listed below!

You’ve probably heard the phrase, “pay yourself, not your landlord.” Basically, it means if you own your own home, you can build equity, and eventually, you may be able to sell your home for a profit, or pass it down through generations. As a renter, the equity in the property where you live doesn’t belong to you, and someone else will reap the benefits of the ownership.

The chart below shows how much you’d be paying your landlord over certain periods of time, depending on how much your rent is. Take a look, you might be surprised!

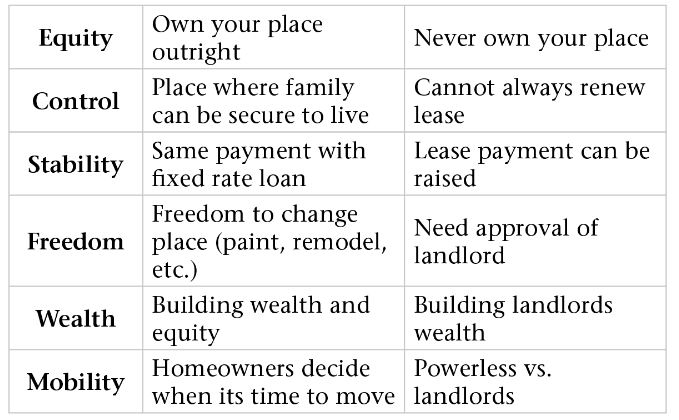

Aside from the figures, you may want to consider these factors as well:

Owning a home is a financial commitment that requires you to plan ahead and reflect on where your life is. So, before you decide to buy, carefully consider the pros and cons of homeownership. If you are, and would like to consider “paying yourself first,” contact one of our lenders!